Get A Quote For One Of The Best Trauma Insurance Products

Aspect offers top-tier Trauma Insurance products designed to provide comprehensive coverage for critical illnesses. With our easy-to-use platform, you can quickly obtain a custom quote that suits your requirements. Our Trauma Insurance covers a range of specified critical illnesses, offering financial support during challenging times. Ensure your family’s well-being by securing one of the best Trauma Insurance products available in the market through Aspect’s streamlined quote process.

From a quote to fully covered in under 10 minutes.

Customise to your needs & get a cover of up to $500,000.

Save by bundling other Accident & Health Insurance products.

Need More Information?

If you are unsure or require more information, please don’t hesitate to

contact us or read our PDS

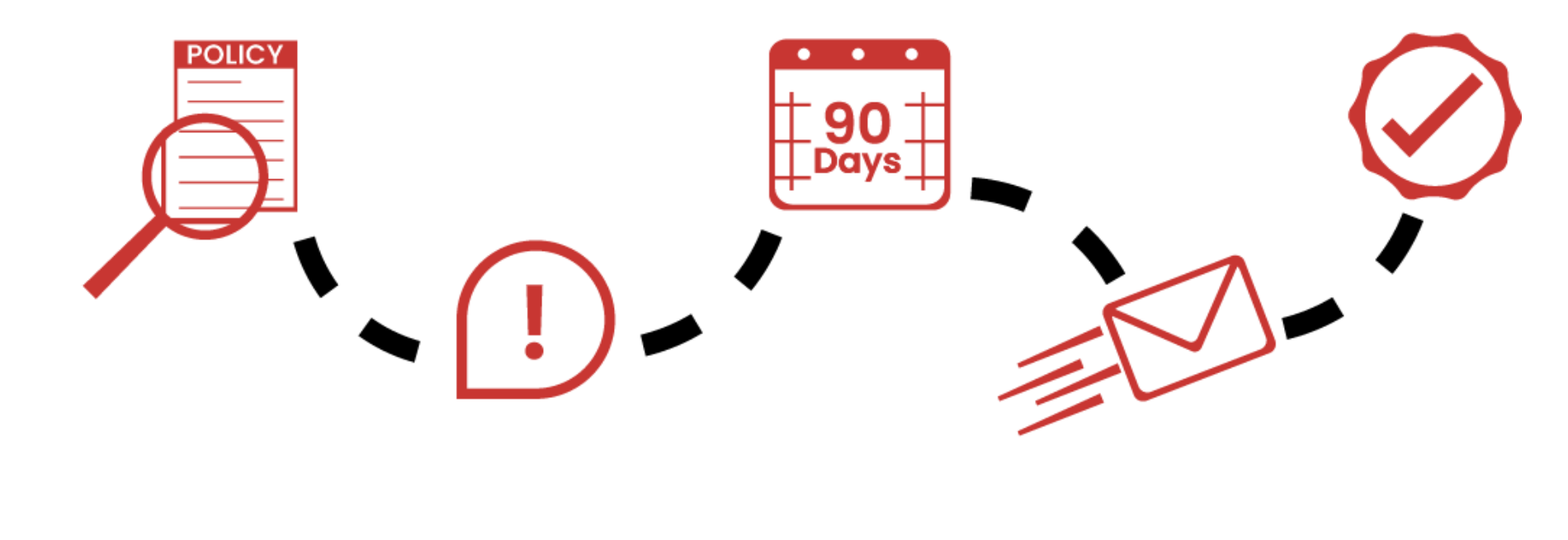

Our Claim Process

Check your policy & cover before making a claim.

Provide proof of claim.

We communicate to you once claim has been processed.

Provide notice to us as soon as reasonably practicable of any injury or illness.

Submit your claim form and supporting documents.

Get In Touch

Find out more about how Aspect Underwriting can assist you with your client’s Accident & Health policy needs and London market placements. if you have a specific inquiry please use our full contact form here.