Get One of the Best Income Protection Insurance Products in Australia

Secure your income and financial stability with Aspect’s top-tier Income Protection Insurance. Our comprehensive product offers coverage for illness or injury that prevents you from working, ensuring you receive a regular income during such challenging times. With flexible options and tailored solutions, Aspect provides one of the best Income Protection Insurance products available in Australia. Safeguard your livelihood and protect your family’s financial future with our reliable insurance coverage.

From a quote to fully covered in under 10 minutes, no phone calls required.

We can cover up to 85% of your income and offer the highest levels of cover in the market.

We offer savings bundles when you purchase income protection insurance with another insurance product!

Need More Information?

If you are unsure or require more information, please don’t hesitate to

contact us or read our PDS

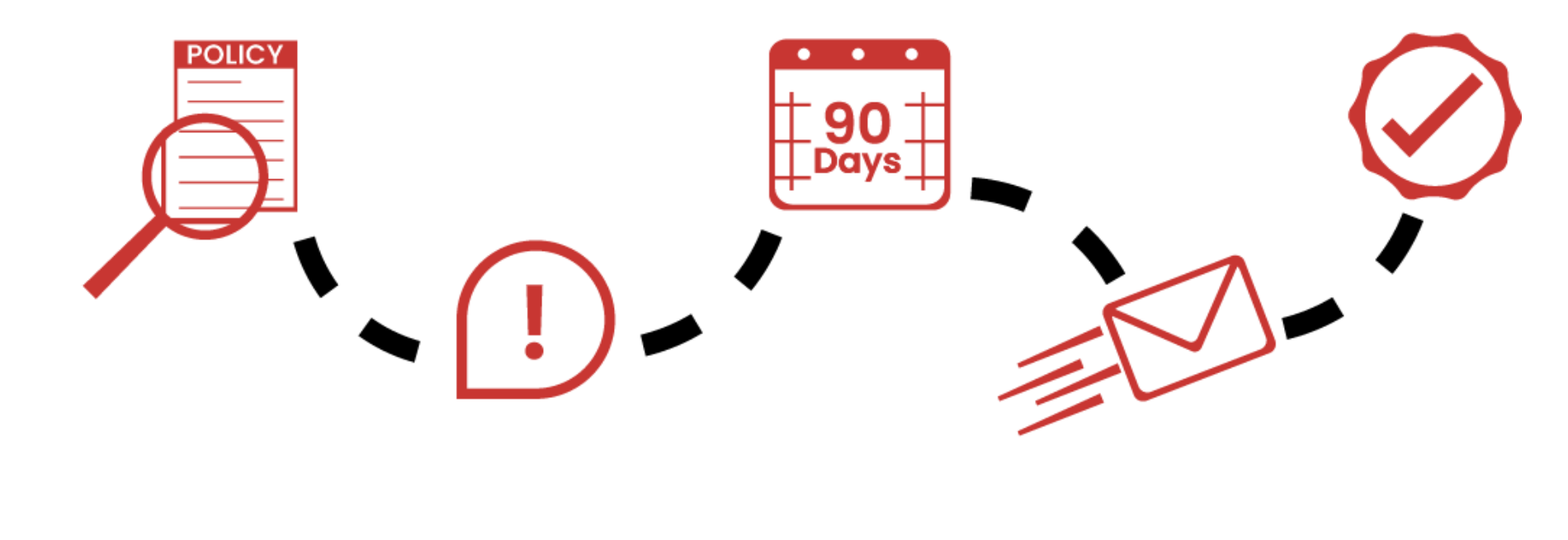

Our Claim Process

Check your policy & cover before making a claim.

Provide proof of claim.

We communicate to you once claim has been processed.

Provide notice to us as soon as reasonably practicable of any injury or illness.

Submit your claim form and supporting documents.

Get In Touch

Find out more about how Aspect Underwriting can assist you with your client’s Accident & Health policy needs and London market placements. if you have a specific inquiry please use our full contact form here.